Scam Awareness Monthly

Learn how to protect yourself from scams, financial fraud, & more!

Securing Online Credentials

Spring is the perfect time to refresh your online security habits.

Tax & IRS Scams

Tax scams are on the rise, don't become a victim this tax season.

Scammer Payment Methods

Beware of scammers demanding payment in cryptocurrency, gift cards, or wires.

Tech Support Scams

Don't a let tech support scam throw shade on your summer fun.

Social Media Scams

Social media brings the world to the palm of our hands, and with it--scams.

Mortgage Scams

If you're buying a new home, you may be targeted for a mortgage scam.

Grandparent Scams

Grandparents, look out for scammers impersonating your grandkids this fall.

Lottery Scams

Learn important tips to stay protected against the latest grandparent scams.

Blackhawk Blog

The latest news you can use!

Donald Millar: Veteran, BHCCU Member, True American

April 3, 2024

We're honored to introduce you to a loyal BHCCU member and honorable US Veteran through a conversation with Indirect Lending Manager, Jeffrey Cross.

Student Loan Debt Repayment Simplified

August 28, 2023

After a historical hiatus throughout the pandemic, borrowers now face federal student loan repayment.

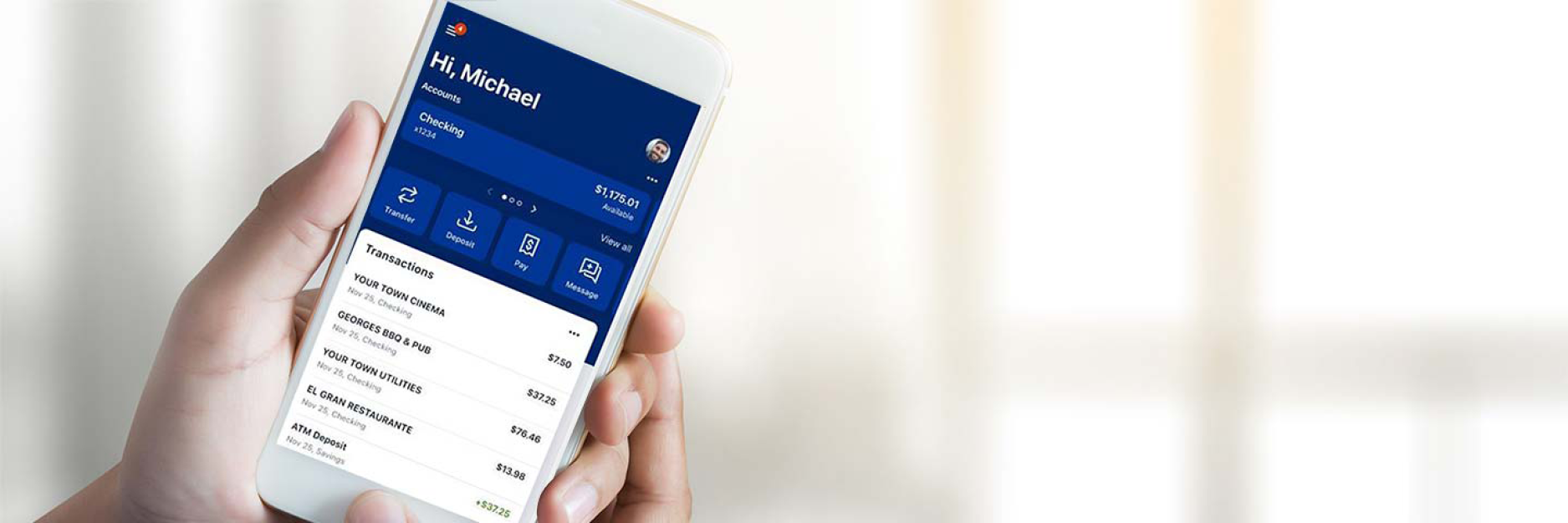

Lock/Unlock your Debit & Credit Cards

September 29, 2020

We have exciting news! You can now lock and unlock your debit or credit cards in online banking and on the mobile banking app.

Fraudulent Robocalls Targeting Area

February 28, 2020

There have been several reports of fraudulent calls in our area. We will never call to request personal or financial information.

Attention, Attention

Keep up with our latest announcements & updates here!

Community Strong

December 15, 2023

Thank you for shopping, eating, and banking local. The smiles on our faces are because of you!

Festival Street Ribbon Cutting Ceremony

August 3, 2022

Join us for a ribbon cutting ceremony to celebrate our Festival Street Sponsorship.

We're a Great Place To Work®!

June 7, 2022

Blackhawk Community Credit Union is proud to be a Great Place To Work® for the second year in a row!

National Paper Shortage

May 30, 2022

Let's all do our part and opt-in to eStatements.

Protect What Matters Most: YOU

August 25, 2021

On Friday, July 9, our very own Angie Hoium, Compliance & BSA Officer gave a talk at Hedberg Public Library(Opens in a new Window) in Janesville, WI.

Making Community Giving More Accessible

August 9, 2021

These past two years have been uncertain times for many, but one thing has always been sure, BHCCU is here for you.

Child Tax Credit 2021

July 8, 2021

Monthly payments through the new federal enhanced child tax credit will be disbursed in monthly installments on these payment dates.

Important Information for Non-Taxpayers

June 18, 2021

If you do not file your taxes each year, the IRS has some tools that can help you claim your economic impact payments.

Empowering our Employees & Future Leaders

May 20, 2021

Each year we select some of our finest to participate in The Leadership Development Academy of Rock County.

Blackhawk Community Credit Union College Scholarships

December 22, 2020

Being a senior in high school means you’ve already studied many long hours and now you’re getting ready for the next step.

Blackhawk Community Credit Union & Its Members Support Local Food Pantries this Holiday Season

November 18, 2020

We have shared Christmases in the past, but never like this before.

Did you hear?

We were in the news. Check out some stories below.

23 WIFR

Blackhawk Community Credit Union installs OAK (Overdose Aid Kits) box in Beloit lobby.

August 25, 2022

Janesville Gazette

Two local women among first female bosses at Janesville’s former GM plant.

March 8, 2020

WCLO Janesville

Judy Ludwig Scott and Julie Monahan two of the first female plant supervisors at the Janesville General Motors assembly plant.

March 6, 2020

Badcredit.org

Blackhawk Community Credit Union is Committed to Enhancing Financial and Medical Well-Being in Wisconsin.

February 12, 2020

CardRates.com

Blackhawk Community Credit Union Recognized for Giving Back to Wisconsin Communities Through Service and Education.

June 11, 2019

Milton Courier

Photo Gallery – Blackhawk Community Credit Union Grand Opening Event.

September 27, 2019

Milton Courier

Blackhawk Community Credit Union Grand Opening is Thursday.

September 23, 2019

Milton Courier

Plan Commission approves site plan for Blackhawk Community Credit Union.

June 4, 2019