Take care of today and plan for tomorrow

Managing your money. It's a simple phrase, but it comes with big challenges. How can you cut back your spending? Grow your savings? Plan for retirement? Pull yourself out of debt? At Blackhawk Community Credit Union, we understand the stakes are high. That's why we provide our members with free tools and financial services that help you address everyday matters and build a better future.

Greenpath Financial Wellness

Financial security is a lifelong journey. But it's not one you have to make on your own. For decades, Greenpath Financial Wellness has helped credit union members understand their options and reach their goals. The national non-profit organization offers a wealth of free services, including:

- One-on-one financial counseling

- Debt management support and advice

- Household budgeting assistance

- Insight on buying a home and avoiding foreclosure

- Free articles, tools, webinars and classes to help you make the best financial decisions

- To learn more, and to start down the path to financial security, visit the Greenpath Financial Wellness website

Introducing your new favorite budgeting tool in online banking...

BudgetWise

Our new online budgeting interface is interactive, easy, and customizable. With BudgetWise, you’re in the driver seat! Our new and improved look gives you all the tools you need to track and manage your spending.

Desktop Overview:

Mobile Overview:

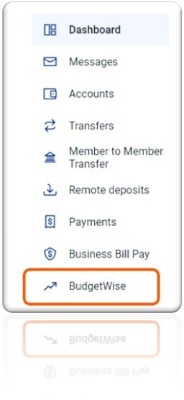

Look for the BudgetWise icon in your online banking menu to get started today!

Financial Calculators

Many of life's biggest decisions involve finances. Our advice is to crunch the numbers and get the most precise information possible. Whether you're looking to purchase a home, buy a car, build up your savings, pay down debt, or plan for retirement, our free financial calculators will provide you with the numbers you need to make the right move for you and your family.

View our Financial Calculators to get assistance with topics such as Mortgage, Savings, Retirement, Credit, and Auto.

Let's work together to keep you in your home

These days, your financial situation can change in an instant. If you lose your job, have a medical emergency or get blindsided by a family crisis, you might be unable to meet your mortgage obligations. The good news is that Blackhawk Community Credit Union offers programs that might help you avoid foreclosure. Please contact us before you fall too far behind in your payments so we can begin working toward a solution.

The Consequences Of Foreclosure

It is important to understand what could happen if Blackhawk proceeds with foreclosure on your home:

- The money you have invested in your home will be lost

- There will be negative consequences for your credit score

- It will be more difficult for you to obtain a mortgage in the future

- You could be held liable for any losses

Options We Might Offer

- Loan Modification: A change to the terms of your loan making it more affordable.

- Forbearance: Reduced or suspended payments for a set period of time, followed by other agreed-upon options to bring the loan current.

- Repayment Plan: A schedule of payments to catch up on past-due amounts.

Act Now

If you are having difficulty making payments to your Blackhawk mortgage, give us a call at 800.779.5555. We have programs that may assist you during these difficult times.

Resources

- Free Credit Counseling: Blackhawk members can receive free budget and debt counseling services through the GreenPath financial wellness program. Visit the GreenPath website or call to speak to a counselor at 1.877.337.3399

- Military OneSource: This is the U.S. Department of Defense’s information resource for those who have served. If you are listed as entitled to legal protections under the Service Members Civil Relief Act (SCRA), please visit Military One Source or call 800.342.9647 for more information.

For a comprehensive list of community counseling agencies, visit the Department of Housing and Urban Development website or call 800.569.4287.

Virtual Budget Workshops

Blackhawk is happy to now offer virtual budget workshops. Take this learning at your own pace and download the free materials that come with the course. Click the link below to start your course.

Budgeting Resources

- Free Credit Counseling: Blackhawk members can receive free budget and debt counseling services through the GreenPath financial wellness program. Visit the GreenPath website or call to speak to a counselor at 1.877.337.3399.

For a comprehensive list of community counseling agencies, visit the Department of Housing and Urban Development website or call 800.569.4287.